The American Key Demo Needs to Get Older

/With America’s Senior Citizens in control of more money than younger generations, it is time for US entertainment companies to more aggressively appeal to older audiences.

In a CNBC report, Ipsos CEO Darrell Bricker stated that, “the single biggest power group in the economy going forward are older women because there's a lot of them and there's more every day.” This came out in 2021 and it has only become more accurate and important. As Bricker shared with me, population data shows that current “female seniors in America are 55% of the senior population, while men are 45%. In 2050 the UN estimates that 63% of American seniors will be women and only 37% will be men. Where the population numbers go is where the money goes. Senior women are the fastest growing age cohort in America today.”

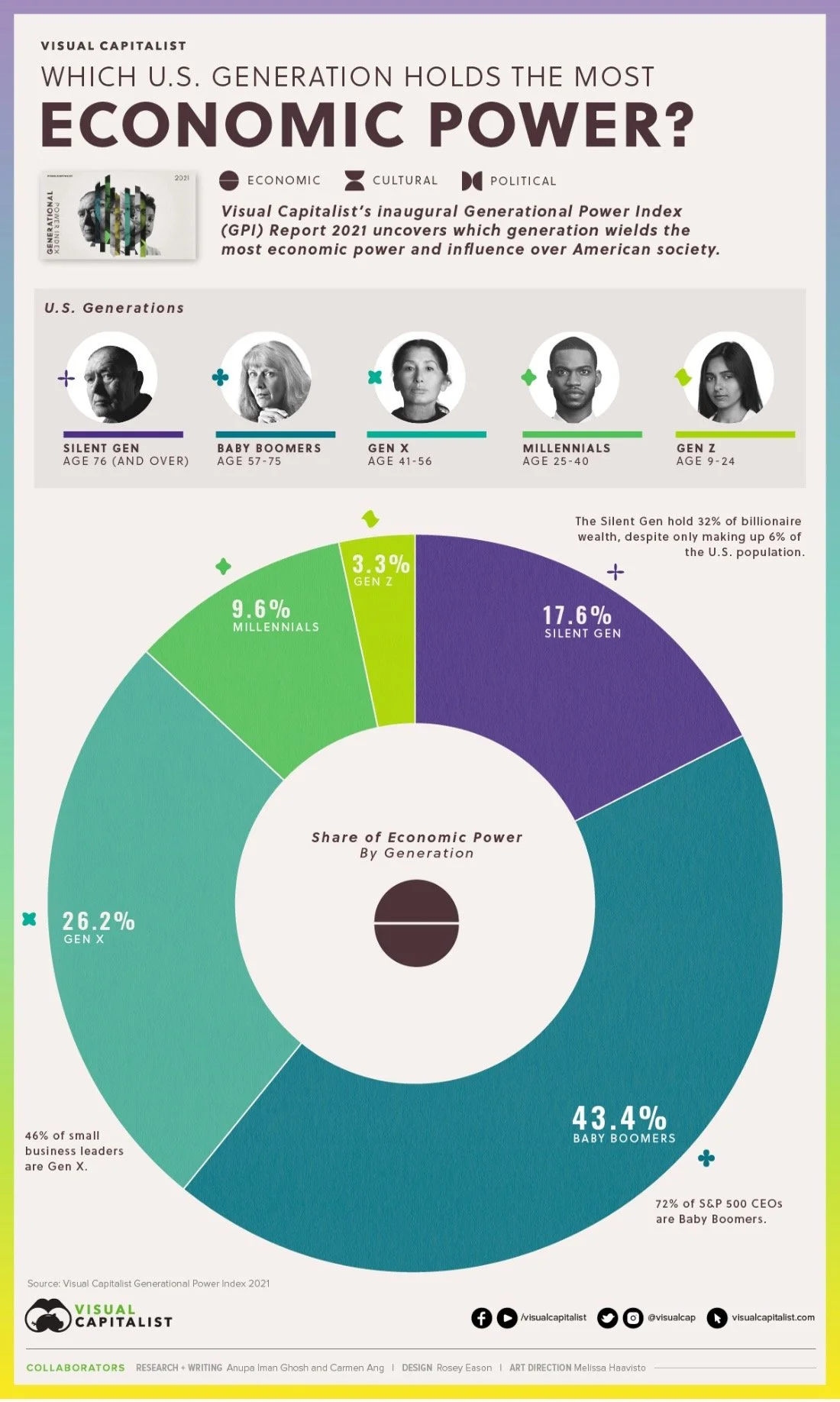

FIGure 1: "Which U.S. Generation Wields the Most Economic Power?" from VisualCapitalist.com's Iman Ghosh and Marcus Lu

With American Baby Boomers having an estimated combined wealth of $75 trillion, an amount of wealth that towers above the $8 trillion held by Millennials, it is time for entertainment companies to change their “Key Demo.” Not only will this change allow them to focus on consumers that advertisers want and who can also pay for their subscriptions, but it will also push studios to make shows and films directly appeal to people who are 50+

But first…

What is the Key Demo?

The key demo is the primary demographic that advertisers and media creators want most as their audience. For decades, the key demo was mostly young people. As Jaime Weinman wrote for Maclean’s, “Young adult viewers have been TV’s target demographic for decades, because they’re thought to have less brand loyalty and more disposable income.”

In the 2002 article “The Most Desirable Demo,” NextTV.com’s R. Thomas Umstead explained why the key demo changed; “with cable-network penetration now pushing toward 90 percent of all U.S. television households, the weight placed on absolute household eyeballs during the 1980s and 1990s has given way to a more narrowly defined, demographic-oriented focus.” And according to Umstead, “no demographic is more desirable than 18-to-49-year-old adults.” [Emphasis added]

People under the age of 50 were so highly valued that audiences 50+ were described as “empty calories.” Umstead shared that while CBS enjoyed ratings success in the early 1990s because it did so well in total viewership numbers for several consecutive years, “those triumphs were the equivalent of empty calories. Because so much of the CBS audience was aged 55 or older…those ratings never translated into major ad dollars.” [Emphasis added]

While the key demo is often associated with television, it overlaps with consumers that movies, games, and sports historically targeted: young and typically male. Through the 1980s and 90s, the video game industry was primarily focused on appealing to males that ranged from being in kindergarten to in college.

(A 1988 Nintendo survey found that only 27% of the audience was female. Additionally, in the documentary Console Wars, Tom Kalinske - the President and CEO of Sega of America from 1990 to 1996 - explained that Sega saw teenage and college age males as its core audience.)

As the American film industry reorientated itself around blockbuster films, the young male demographic became a key demographic for movie producers. “The whole notion of the summer blockbuster has always been built around young men,” Comscore, Inc’s Senior Media Analyst Paul Dergarabedian told the New York Times in 2015.

But as Dergarabedian further explained, the importance of young men as a demographic is fading, “I think we’re about to see that change. The clout and importance of the female audience has never been bigger.”

And a reason why audiences who aren’t young and male are becoming more important is because…

The Financial Power of Young Men is Collapsing in Real Time.

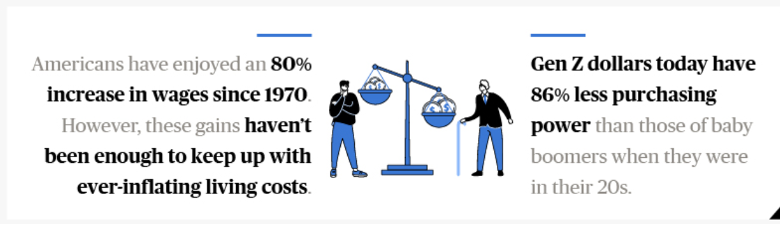

The above is not hyperbolic. In general, Millennials and Gen Z have far less economic power than Boomers did. According to ConsumerAfffairs.com, “Gen Z dollars today have 86% less purchasing power than those from when baby boomers were in their twenties.” Zooming on a specific example of this generational disadvantage, “Gen Zers and Millennials are paying 57% more per gallon of gas than baby boomers did in their 20s.” Even more troubling, Millennials and Gen Z “are paying nearly 100% more for their homes than baby boomers did in their twenties.”

Figure 2 - Consumer Affairs, "Comparing the costs of generations"

Moreover, sectors that have relied on young men for the last decade have been especially gutted by this economic downturn; two of these are esports and crypto.

The esports sector has been largely male for years. As one report states, “despite the split between male and female video game players being very close to 50:50, the esports audience is still predominantly male,” with over 80% of the esports viewers being male.

During the 2010s esports became so popular myriad articles were published proclaiming that it would eclipse the NFL and other traditional sports. A 2017 Business Insider article, linked the NFL’s then lower ratings to young men being more interested in esports. Flashforward to 2023 and the NFL, NBA, and other sports have high television ratings while viewership for esports has dropped.

(Of note, for the 2023 Super Bowl, advertisers were actually focused on targeting people 50+ because, according to Danielle McMurray, “with younger audiences cutting back on spending, marketers are wise to focus on the 50+ audience.”)

In the last few years Venture Beat has reported that the middle class of esports is dead and Bloomberg has covered that, “the hype around esports is fading as investors and sponsors dry up.” Moreover, esports leader FaZe Clan, which once was valued at over $1 billion in 2021 has lost over 90% of its worth.

Figure 3- Since FaZe Clan went public, its stock value hit a high of $24.69 only to collapse to less than a dollar.

In regards to crypto, as Marisa Dellatto wrote for Forbes in November 2021, crypto’s super users were young men. That was the same month the total crypto market hit a value of over $3 trillion. Since then, the value of the total crypto market has plummeted more than 66%.

Figure 4 - Overall cryptocurrency market capitalization per week from July 2010 to March 2023 (in billion U.S. dollars) from Statista.com.

Returning to the topic of television, recent economic contractions and business deals have brought to light information that suggests that young adult audiences have not been economically viable consumers for over a decade. For example, The CW was created in 2006 when CBS and Warner Bros. merged their respect networks, UPN and The WB, into one new network. When Paramount and Warner Bros. Discovery sold their controlling interests in The CW to Nexstar in October 2022, something shocking was revealed about The CW. The CW, a network known for appealing to the key demo of people between 18 - 35, a network that had hit shows such as America’s Next Top Model, The Flash, Supernatural, Arrow, The Vampire Diaries, Gossip Girl, and many others, “has never been profitable.” [Emphasis added]

In 2018, Charles Lane wrote for NPR that the influential male demographic was waning. “Men between the ages of 18 and 34 have been a key demographic for marketers for years,” Lane said. “That's starting to change, say some marketing experts, who say the economic fortunes of these men have declined.”

The prediction made by Lane is now here, and…

The Shift is Already Happening.

The economic power of older women is already impacting the economy and non-entertainment brands are beginning to take note. For instance, PYMNTS noted that the beauty industry has placed “a renewed emphasis on older women as a means of capturing the attention of one of the wealthiest cohorts of consumers.”

And “wealthiest cohorts” does little to truly communicate just how economically powerful this demographic is. This is because American women over the age of 50 “represent over $15 trillion dollars in purchasing power.”

Older people are already flexing their superior buying power. As James Rodriquez wrote for Business Insider, boomers are buying homes at a substantially higher rate than millennials.

“Between July 2021 and June 2022, boomers were the largest share of homebuyers for the first time since 2012, according to new data from the National Association of Realtors,” Rodriquez penned. “Boomers purchased 39% of all homes that sold during that span, up from 29% the year before. Millennials, on the other hand, saw their share of the market shrink to just 28%, down from 43% the year prior.”

Rodriquez further stated, “despite the numbers game favoring millennials, a slew of other factors conspired to allow boomers to stick it to their successors. The main thing, though, was cash. Boomers are more advanced in their careers and in many cases have already spent decades amassing home equity, making them much more likely than other generations to fork over all cash for their next property. And when bidding wars become the norm, it pays to offer a lump sum.”

There is also a gendered component to this because single women are buying more homes than single men. In every state except North and South Dakota, women own more homes than men. According to Khristopher J. Brooks, “single women own roughly 10.7 million homes, compared to 8.1 million for single men.”

Figure 5 Source: USAFacts.org - "Which generation has the most wealth? Baby boomers have the highest net worth, averaging $1.6 million per household"

And remember, the wealth that older generations currently have will persist for decades to come. As research from USAFacts.org documents, "baby boomers have the highest household net worth of any US generation." USAFact.orgstates, "with most baby boomers financially planning for at least a few more decades, they benefit from wealth earned from long careers and have more robust retirement accounts than” other generations.

Furthering this gap in economic buying power is that student loan payments will restart in October 2023. According to Apollo Global Management’s chief economist Torsten Sløk, it is estimated that student loan repayments resuming will, “subtract roughly $9 billion from consumer spending every month, or roughly $100 billion a year.” Sløk goes on to point out that this, “will mainly have an impact on younger households.”

In short, older women can buy houses in the real world; younger adults can only buy houses in virtual worlds.

And in regards to entertainment…

This is Already Impacting the Entertainment Industries.

A Comscore/AARP study found that older audiences returned to movie theaters in 2022 in numbers that outpaced their attendance before the pandemic. “According to the data,” the report notes, “the attendance of people 45 and older grew five percent from previous attendance levels in 2019, the last full year before the COVID-19 pandemic affected theater attendance.” A movie that significantly benefited from this was Top Gun: Maverick, which benefited from nearly 40% of its audience being 45 or older.

Even Barbie, the film with the biggest box office of 2023, somewhat reflects these trends. For instance, 18-24 year olds only made up 27% of Barbie’s opening weekend. Evidence suggesting that Barbie’s success is partially due to an overrepresentation of people outside of the key age demo.

It isn’t just the traditional theatrical experience that appeals to older audiences, because television is finally catching up. As Warner Bros. Discovery Chief US Advertising Sales Officer Jon Steinlauf said in May 2022, “our most affluent viewers are adults 50+….They account for over 50% of all US consumer spending. A large majority of them watch us every month.”

In the world of streaming, people 50+ have recently become the largest age group in this sector. According to the Decider’s Greta Bjornson, for the “first time ever, consumers ages 50-64 are streaming more TV than the generation below them.” On top of this, Netflix has announced plans to better appeal to older consumers. And while networks used to see senior citizens as “empty calories,” Yellowstone has become one of the most popular shows in the country due to appealing to older audiences.

Similar to Yellowstone, if we go back to August 2022 and look at Netflix’s top show, we’d find that Stranger Things was knocked out of the number 1 spot by Virgin River, which, according to AdWeek, had a “viewing audience [that] was nearly two-thirds over 50 and almost a third over 65 years old.”

We aren’t just seeing older audiences become more important, we are also seeing older talent becoming essential to shows or movies finding success. According to a study from the National Research Group, people were asked to name movie stars that could get them to see a movie. Nineteen of the top 20 actors named were over 40; the only exception being Chris Hemsworth who was 39 at the time of this research. Even when the list expands to the top 100 actors, only 13 are under the age of 40 when the study was conducted.

And we are beginning to see this consumer power of older women impact the video game industry. An April 2023 AARP report, “Gamers 50-Plus Are a Growing force in the Tech Market,” found that gamers over the age of 50 are now a population of 52.4 million, roughly 45% of all Americans in that age range. On top of that, “in 2023, older adults’ continued interest in gaming could lead to $2.5 billion in biannual spending on digital and physical game content.”

As CBS’s Chief Research Officer Radha Subramanyam recently said, “at CBS, we love older viewers. They watch a lot of television. And advertisers love them because they have tons and tons of spending power.”

Not only is this group increasingly spending more money, it skews female because 52% of the women in this demographic play every day vs. just 37% of men.

But now the question is…

The Future is Silver and Female, What Should Be Done?

“The 18-34 year old demographic has traditionally been the most coveted by Hollywood,” Comscore, Inc’s Senior Media Analyst Paul Dergarabedian shared with me. “But in recent years, the realization that mature audiences not only have the discretionary income but also the desire to consume big screen and small screen entertainment should inspire studios and producers to tailor films and TV shows that have appeal to those over 40.”

A soon to be real world example of this appeal to seniors is The Golden Bachelor, which is a twist on The Bachelor franchise but will center its focus on a 72-year-old man looking for love among women who are in their 60s and 70s. And The Golden Bachelor is not alone. As New York Times article by John Koblin points out, The Golden Bachelor will be joining a landscape slowly pivoting to appeal to older audiences with shows such as the continuation of the original Law & Order, and reboots of Magnum, P.I. and Matlock. Even Abbot Elementary, a hit show that feels as though it appeals to a young audience, has a viewership with a median age of 60.5.

With people 55+ becoming more digitally literate and expected to be the dominant consumer group for decades,[1] major entertainment brands are facing a consumer landscape in which young people are simply not a worthwhile group to pursue. Or as Ryan Glasspiegel wrote for Barrett Sports Media, “Baby Boomers Have All The Money, Brands & Advertisers Have To Pay Attention.”

Of note, this is not advocating for uninspired entries from legacy franchises to be created. Instead, it is advocating for films and shows to be made that highlight actors older audiences enjoy or that have narratives important to Boomers.

For entertainment companies in need of advertiser and subscriber revenue, embracing this shift means more than just producing more Yellowstone spinoffs (with that said, no one is against more Yellowstone). It means doing more to craft shows and films that resonate with people 55+. This could be more movies like 80 For Brady or a reboot of The Golden Girls, but it also means content that speaks to the everyday human experience of getting older and wanting more out of the life one has left.

As the value of media companies have plummeted, many industry experts have provided several smart reasons as to why so many streaming platforms are failing. But what they often overlook is the generational wealth gap and the customers these new media companies focused on. Digital media leaned heavily into a generation with little disposable income, a lot of debt, and a job market in which entry-level jobs will be taken by AI. So, while linear entertainment may appeal to the olds, it is the olds who have the cash. And if the entertainment industry wants to continue to see green it will have to follow America’s population into its golden years.

[1] Visa’s Wayne Best, Senior Vice President and Chief Economist wrote in this 2018 report, “baby boomers (those born between 1946 and 1964) have continued to dominate consumer spending in the U.S. In fact, consumers over 50 now account for more than half of all U.S. spending. They are also responsible for more spending growth over the past decade than any other generation, including the coveted millennials.”

“As a group,” Best continued, “this over-50 crowd should continue to be a major force in U.S. consumer spending, especially as those over 60 years old drive growth over the next five to 10 years.”

Additionally, Edward Yardeni, an economist and founder of Yardeni Research, believes that spending by Boomers could delay the next recession.

Biography

Nicholas Yanes Ph.D. is a digital vagabond who now works on developing artificial intelligence systems. Having drifted away from traditional academia, Yanes’s non-AI professional work centers on analyzing entertainment industries, contributing to M&A research, and periodically publishing an awesome article now and then. (Check out The Birth and Death of Budcat Creations, Iowa’s First and Only Triple-A Game Studio.)

His first book, The Iconic Obama, examined the 2008 presidential election and its relationship to popular culture. And his second book, Hannibal for Dinner, reflects on Bryan Fuller’s adaptation of Dr. Hannibal Lector’s adventures. Yanes has written for CNBCPrime, MGM, ScifiPulse, Sequart, the Casual Games Association, Shudder’s blog The Bite, and several other publications.

More about Yanes can be found at his LinkedIn profile.